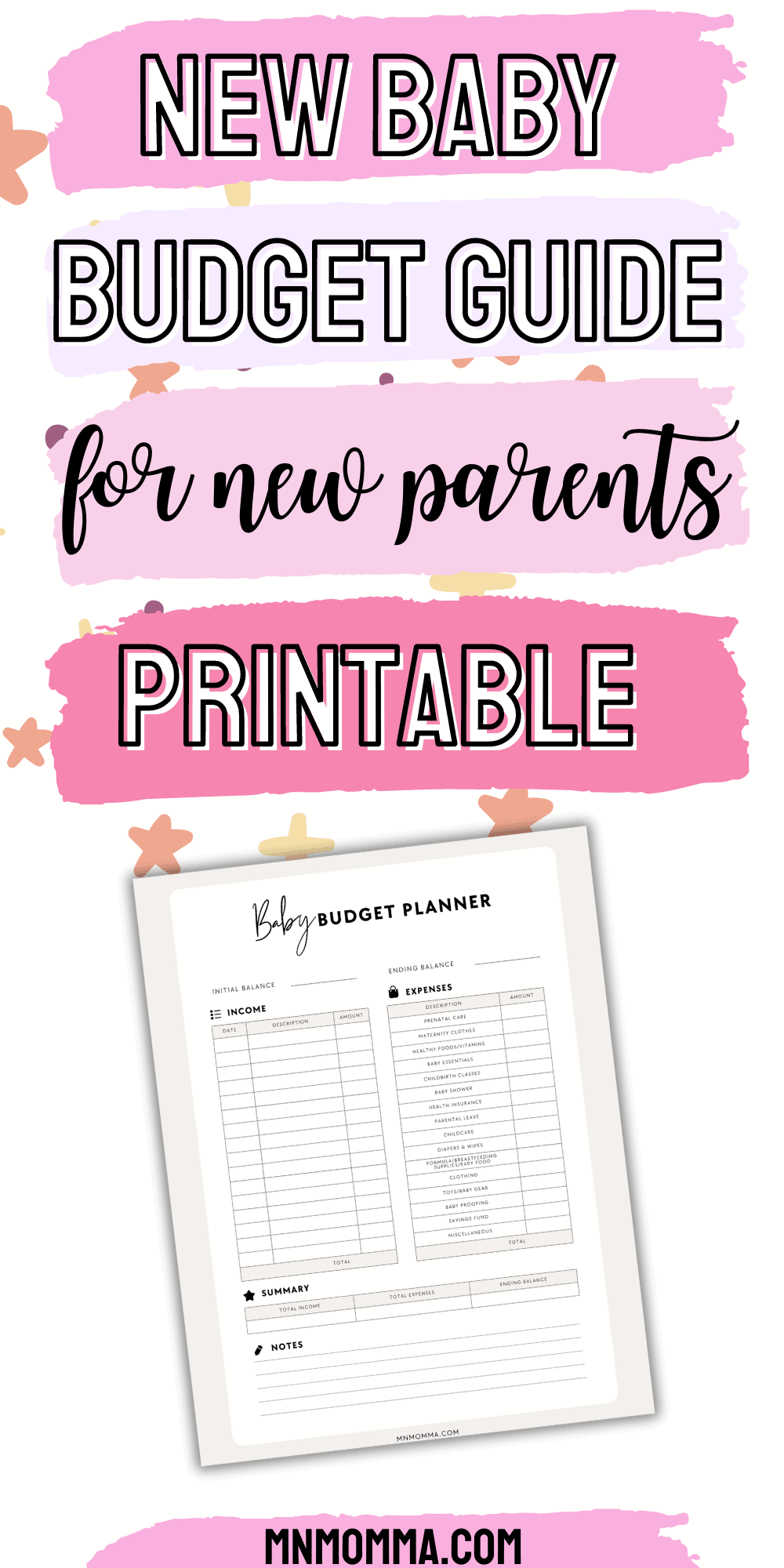

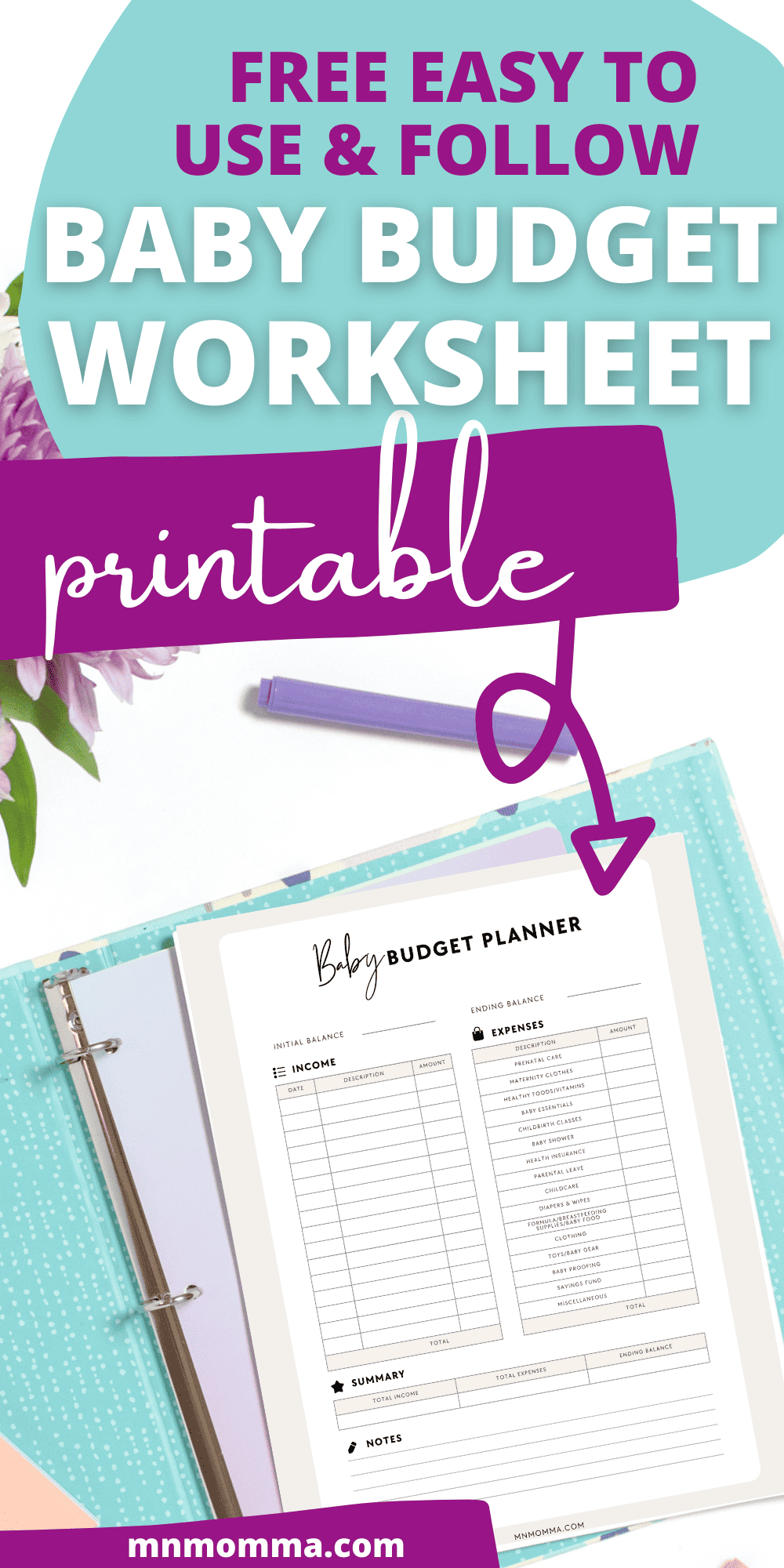

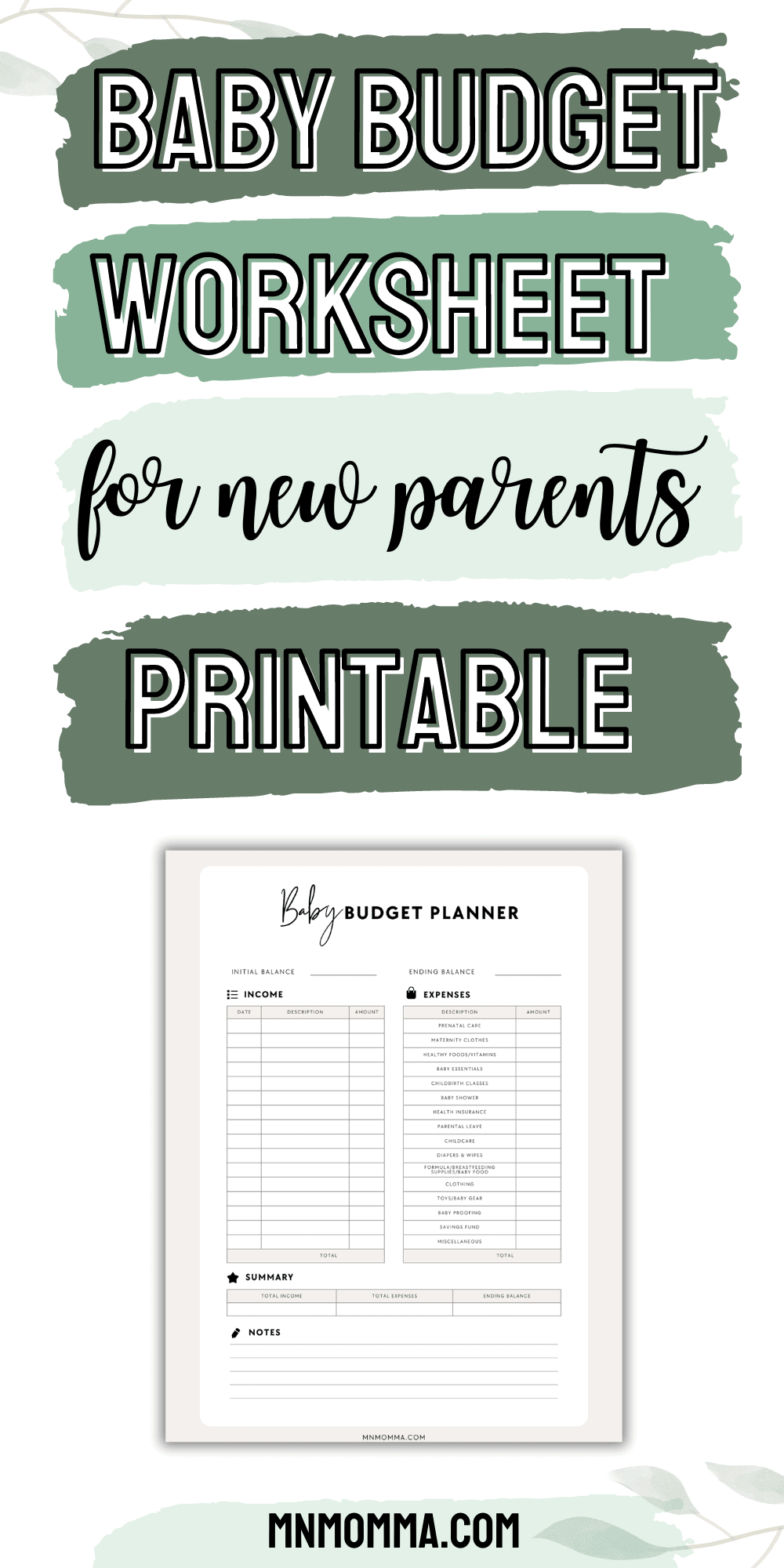

The New Parent Baby Budget Worksheet (+ Free Printable)

Disclosure: This post may contain affiliate links, which means I may receive a small commission if you click a link and purchase something. Please check out my disclosure policy for more details. All opinions are my own!

Budgeting for a brand new baby isn’t for the faint of heart.

But it’s absolutely a smart and responsible parent thing to do.

Thankfully, this new parent baby budget worksheet (check it out below!), will help guide you through budgeting for a new baby and the big moments that come along with it.

We’ve all heard the statics on the cost to raise a baby these days – and it’s scary.

With all the new expenses that come from a new addition, such as baby clothes to medical bills, there seemed to be a never-ending list of things to consider.

I’m not here to freak you out, but instead, hopefully, to ease your worries or help you put a plan into action to succeed.

And a budget is a great place to start.

<— Pin it! Save this post for later!

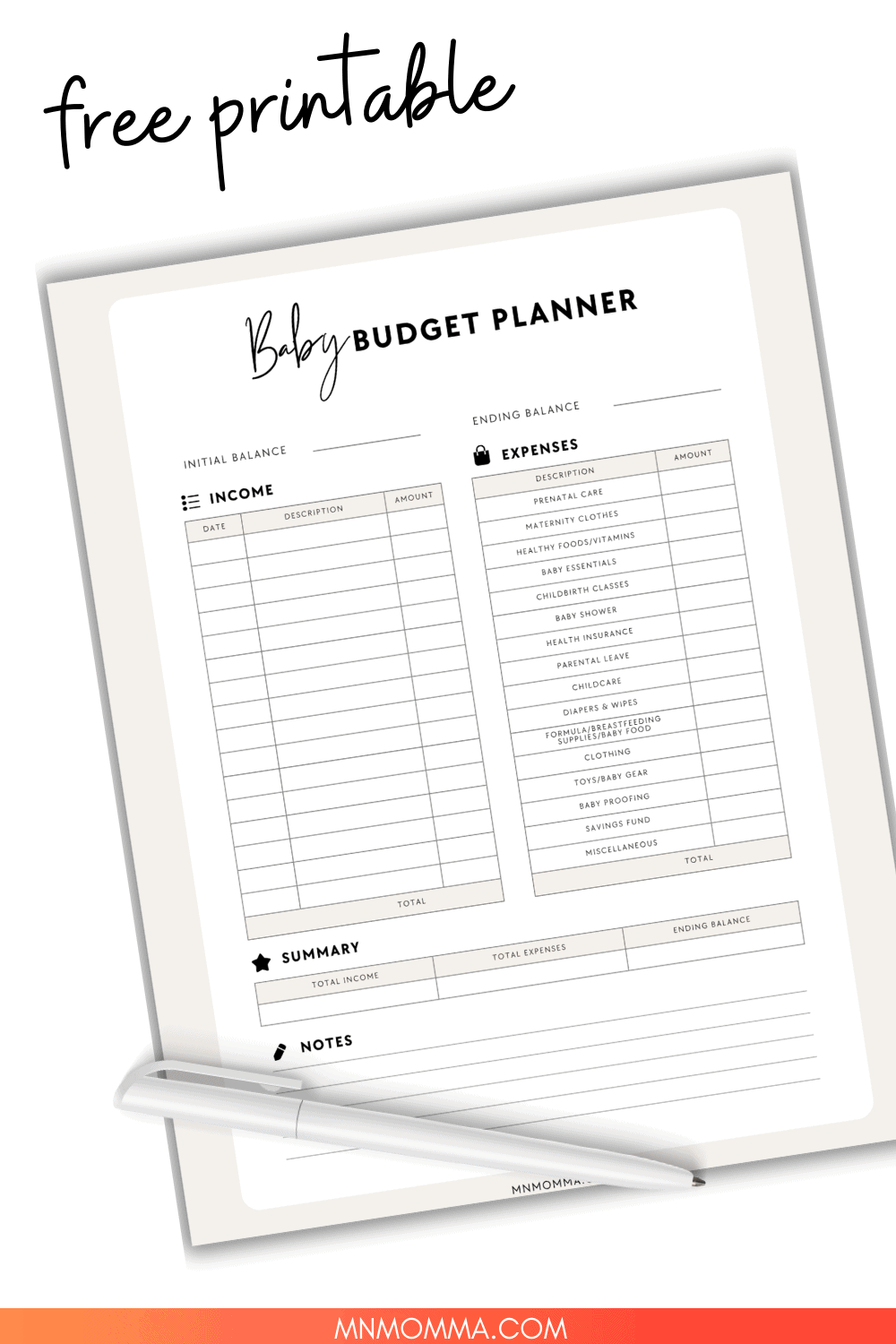

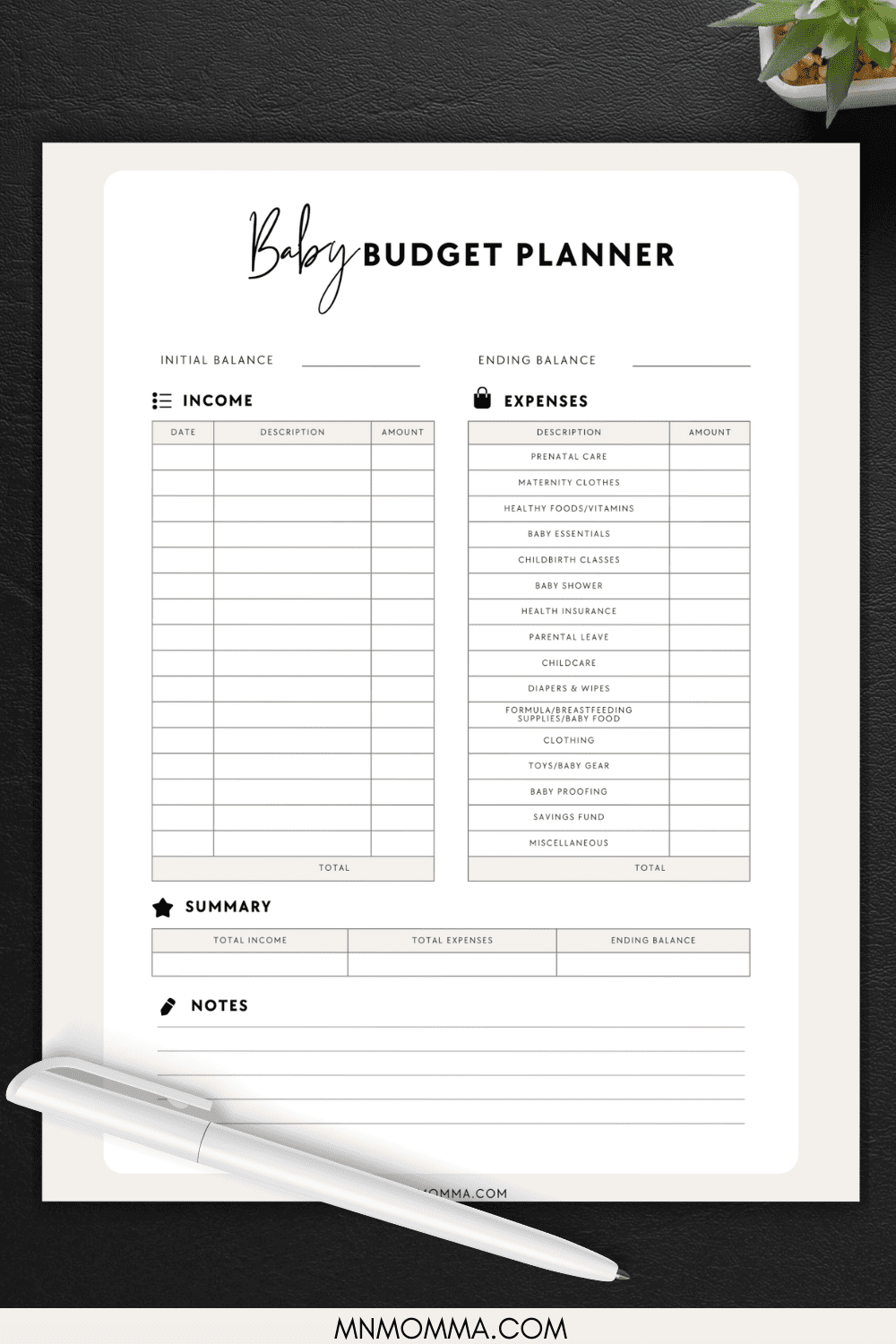

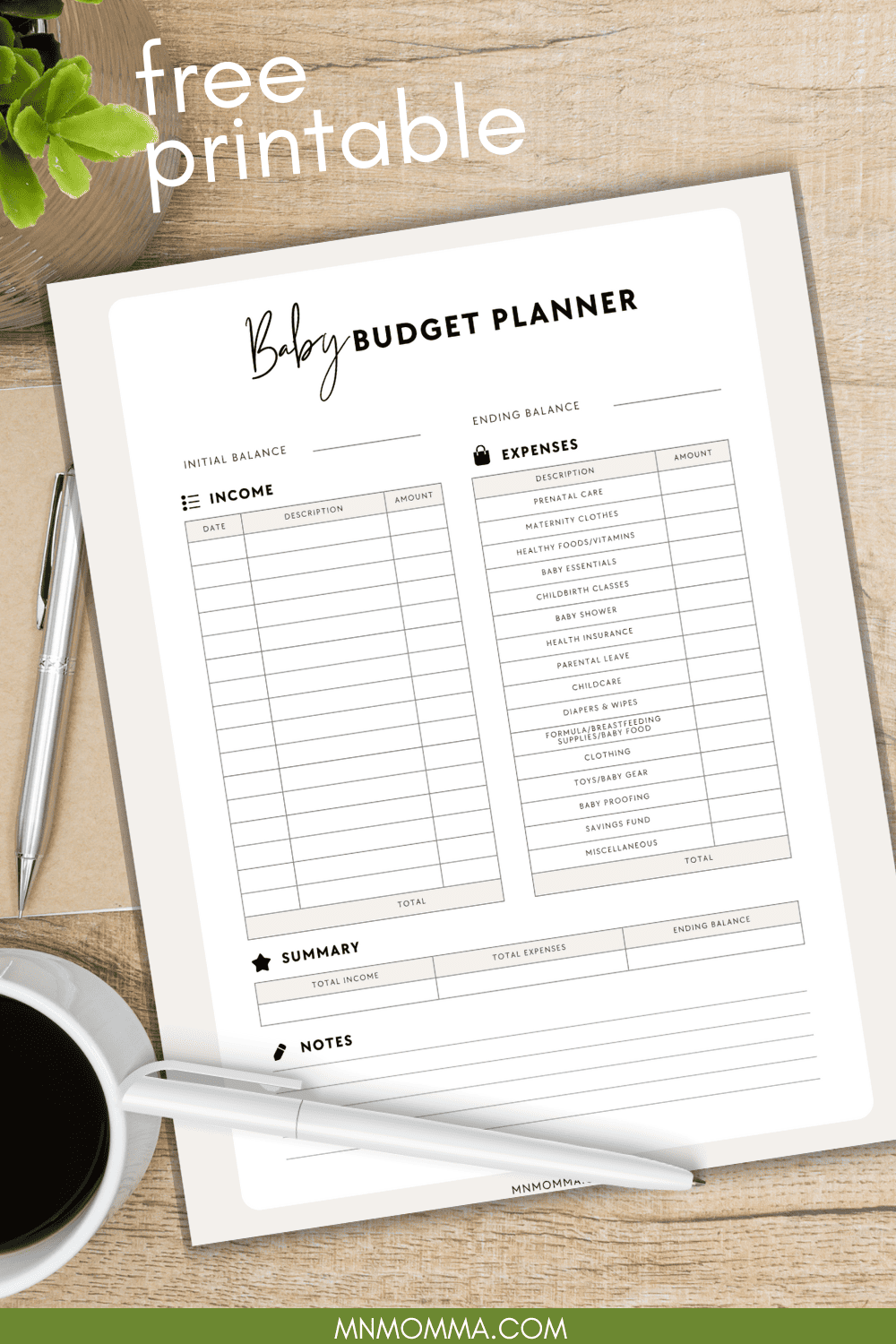

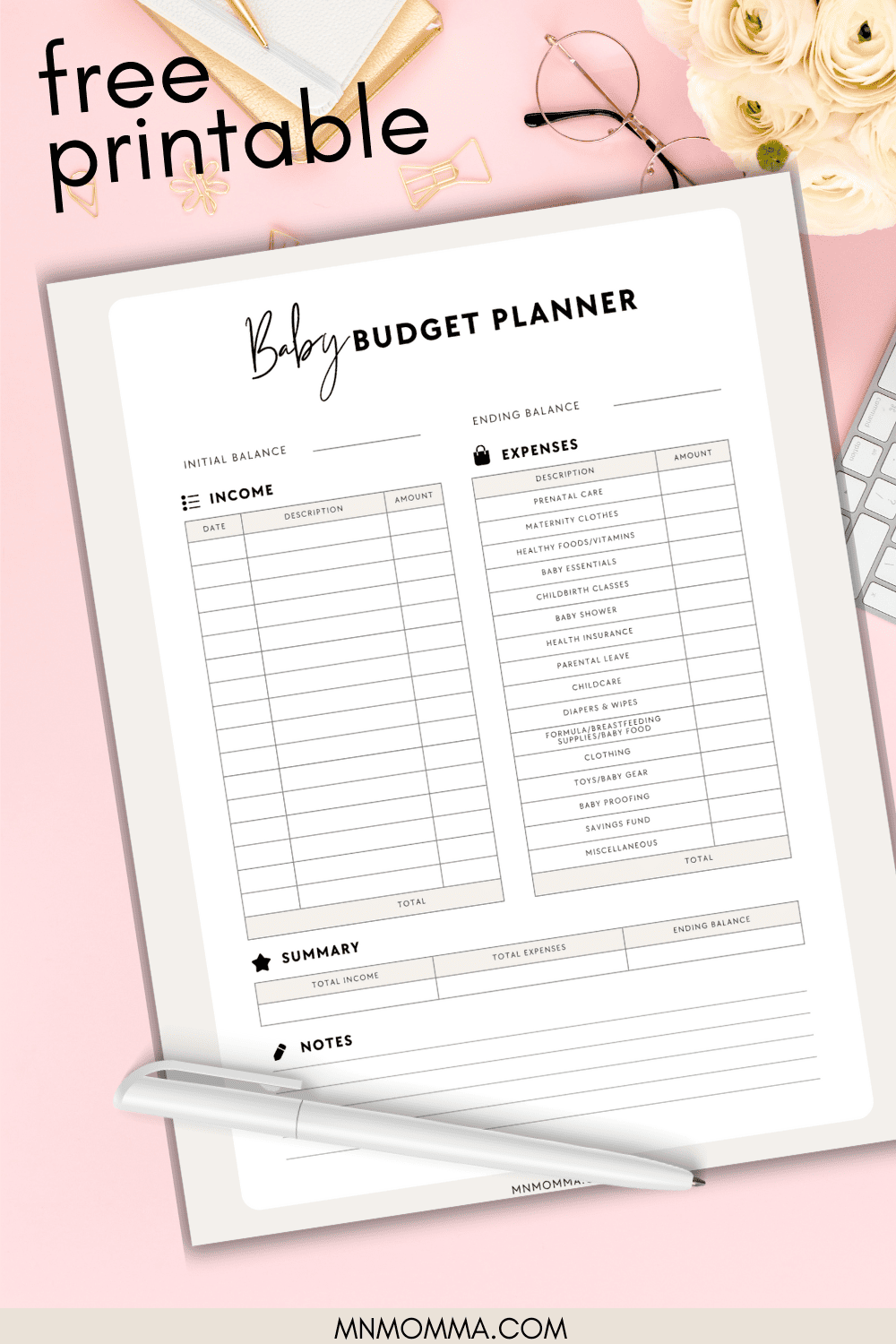

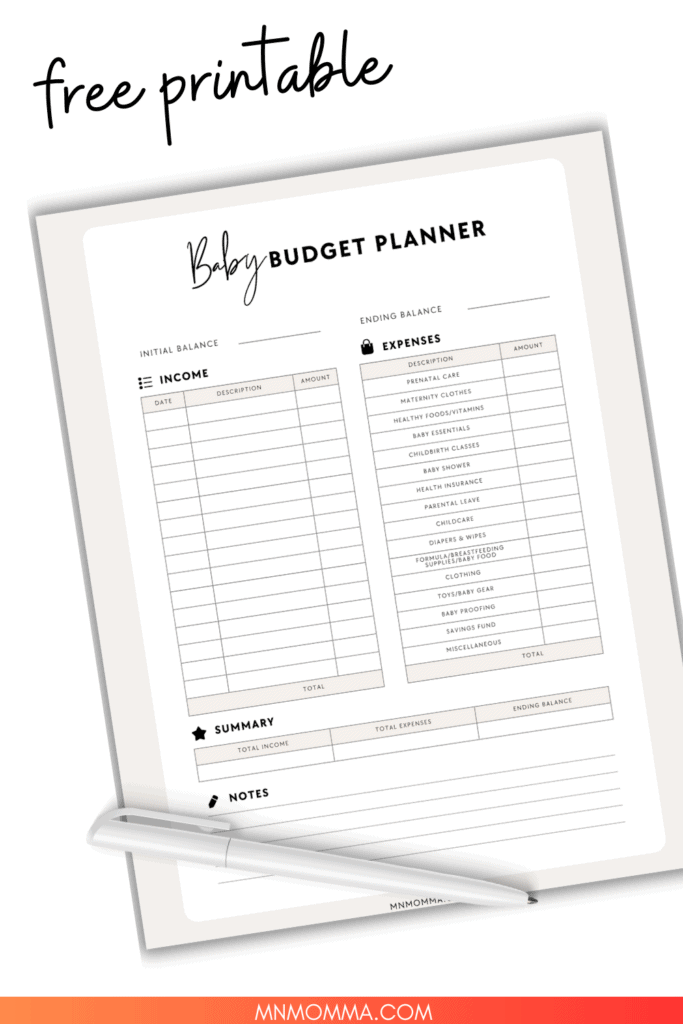

Free Printable Baby Budget Worksheet

Before we get into all the details of what should be included in your budgeting for baby, here’s where you can quickly grab a copy of your free baby budget worksheet.

This is a printable budget worksheet for expecting/new parents, that’s blank for YOU to fill out with your estimated cost for each baby related category.

The categories range from pre-baby things, such as prenatal care, maternity clothes, childcare holds, etc. to after birth items such as diapers, formula, daycare, and more.

Below, I talk about each baby section in more details and give you a good idea of how much you should budget for each part.

Here’s what’s included in the free, printable baby budget worksheet:

- Initial balance

- Income list (date, description, amount)

- Expenses (description & amount)

- Summary of Income/Expenses

- Ending balance

- Notes

It’s also simple, cute, and you can re-print it as many times as you need if your situation changes.

What to Budget for Before Baby Arrives

Congratulations! You’re pregnant and I hate to say it, but the budgeting starts now – before baby even arrives.

Budgeting during pregnancy is vital to ensure you’re financially prepared for the upcoming months and the arrival of your little one.

Let’s dive into some important things to consider when creating your pregnancy budget.

Prenatal care

To keep you and your baby healthy, prenatal care is a must.

Chances are good your prenatal care medical expenses will include:

- prenatal visits

- ultrasounds

- lab tests

- any required medications

I found that we didn’t pay a dime during my pregnancy, as prenatal care was covered, but then paid for my delivery once baby arrived.

Be sure to check with your health insurance provider to understand what’s covered by your insurance and what you will be responsible for. No one likes surprise expenses, and this is the best way to keep those surprises away.

Estimated Expense: varies

Maternity clothes

As your baby bump grows, you’ll likely need to update your wardrobe.

Some moms are able to wear their maternity clothes until late into pregnancy, while others are swapping out for new clothes before the end of the first trimester.

It’s a great idea to budget for maternity clothes that will keep you comfortable and stylish throughout your pregnancy.

Estimated Expense: $300-$500

Healthy nutrition

Eating well during pregnancy is crucial for your baby’s development.

If you’re not used to eating a variety of healthy foods, consider adjusting your grocery budget to accommodate for pregnancy super foods, like fresh fruits and vegetables, lean proteins, and whole grains.

Estimated Expense: free-$100/month

Baby essentials

While you’re still pregnant, it’s a good time to start thinking about the basic items you’ll need for your little one.

You don’t have to go crazy, especially if you plan to have a baby shower or sprinkle, but you’ll definitely need a few items.

Include expenses for items such as a crib, stroller, car seat, diapers, bottles, and other baby gear in your budget and remove them if you receive the items as gifts.

Estimated Expense: $100-$500

Childbirth classes and resources

If you plan to take childbirth classes or hire a doula or midwife, be sure to include these costs in your budget.

These resources can provide valuable knowledge and support during your pregnancy and delivery, and I highly recommend looking into them.

There are several great online options as well, if you can’t make an in person one.

Estimated Expense: $50-$200

Parental leave

Who’s going to be staying home once baby arrives?

Both parents briefly? For an extending period of time?

Only mom?

For how long?

With or without pay?

These are all super important questions to find out and budget for before baby is born.

Check with yours and your spouses’ companies’ policies regarding paid or unpaid parental leave and calculate the impact on your income

Research whether you are eligible for any maternity leave benefits through government programs or your employer and understand the requirements and the amount of financial support you may receive during your time off work.

After all this checking calculate the impact this leave will have on your income and set your budget up accordingly.

Estimated Expense: varies

Baby shower expenses

If you plan to have a baby shower, consider the costs associated with hosting the event, including decorations, invitations, food, and gifts for the guests.

Often times someone else may offer to throw your baby shower for you and you won’t need to worry about these expenses, but they’re good to keep in mind.

Estimated Expense: free-$250

Health insurance coverage

Review your health insurance policy to understand how much you will be responsible for in terms of hospital fees, prenatal tests, and delivery costs.

You’ll also want to ask about how, when, and how much it may cost to add your newborn baby to your plan.

Estimated Expense: varies

Childcare

I know. Your baby isn’t even here yet and you’re already paying for childcare expenses?

Be aware that many daycare centers and providers require a fee to hold your spot until baby arrives.

If you have older children attending that childcare already, the owner may be willing to wave the holding fee – be sure to talk with your center/provider to find out the rules and requirements.

Estimated Expense: free – $1000

Unexpected expenses

Keep in mind that unexpected costs may arise during your pregnancy, such as additional medical tests or treatments.

It’s always smart to allocate some funds for unexpected expenses to an emergency fund to avoid any financial stress.

Remember, every pregnancy and financial situation is unique. Adjust your budget based on your specific needs and circumstances.

Budget Considerations After Baby Arrives

The first year of your baby’s life is filled with joy, milestones, and, of course, new expenses.

Here’s some important things to include in your budget during baby’s first year:

Diapers and wipes

Disposable diapers and wipes are a significant ongoing expense during the first year. Estimate the number of diapers your baby will go through each month and factor in the cost.

You can also consider using cloth diapers as a more cost-effective and eco-friendly alternative.

Estimated Expense: $50/month

Formula or breastfeeding supplies

If you’re formula feeding, budget for the cost of formula, bottles, and sterilizing equipment.

If you’re breastfeeding, consider expenses such as breast pumps, storage bags, nursing bras, and lactation consultations if needed.

As a breastfeeding and pumping mom, I was shocked at how much feeding a baby from ME could actually cost.

Estimated Expense: free – $200/month

Baby food

As your baby transitions to solid foods, there will be additional costs for baby food jars, pouches, or ingredients for homemade baby food.

Even if you don’t choose the homemade route, you’re still feeding another person – and you’ll need to account for them in your budget.

Most babies start solids around 6 months old, so you’ll have a few months before needing to address this cost in your budget.

Estimated Expense: varies

Childcare

If both parents are returning to work or if you require childcare for any reason, include the cost of daycare, nanny services, or babysitters in your budget.

Research local options and factor in any registration fees or deposits required.

Estimated Expense: $750-$3000+/month

Health-related expenses

Account for medical check-ups, vaccinations, and any unexpected medical costs that may arise during your baby’s first year.

Many insurance companies cover well baby checks and vaccines, but taking your baby in for their first cold or illness may not be covered by your medical insurance.

It’s wise to have a buffer in your budget for these expenses.

Estimated Expense: varies

Clothing

Babies grow SO FAST.

It’s wild!

Budget for clothing that will fit your little one at each stage of development.

Consider second-hand options or hand-me-downs from family and friends to save money on baby clothes.

Estimated Expense: $300

Toys and developmental items

Babies are curious little people and learn SO much from you and their surroundings during the first year of life.

That said, they do benefit from toys and developmental items that aid their growth and motor skills.

Allocate a portion of your budget for age-appropriate toys, books, and educational materials.

Estimated Expense: $250

Baby gear

Throughout the first year, you may need to purchase or upgrade essential baby gear such as a car seat,

Plan and budget for these larger expenses in advance.

Estimated Expense: $400

Babyproofing and safety measures

As your baby becomes more mobile, you’ll need to invest in babyproofing measures such as outlet covers, cabinet locks, baby gates, and corner protectors.

Set aside some money in your baby budget for these safety items.

Estimated Expense: $150 – $300

College Fund/Savings/Investments

If your budget allows for it, contributing to a college fund or other savings and investments for your child can be a huge benefit to them down the road.

Estimated Expense: varies

Miscellaneous expenses

There will always be unexpected or miscellaneous expenses that arise during the first year.

It’s a good idea to have a buffer or contingency fund to cover any unexpected costs, such as medical emergencies or repairs to baby equipment.

Estimated Expense: varies

Remember to revisit and adjust your budget regularly as your baby’s needs change. As your little one grows, some expenses may decrease while others may increase.

By staying on top of your budget and tracking your spending, you can ensure you’re prepared for the financial aspects of your baby’s first year.

Tips to Save Money on A Tight Budget

When it comes to saving money on your baby budget, there are several tips and strategies you can use.

Here are some valuable ideas to consider:

1. Create a baby budget spreadsheet or use a baby budget template: This will help you track and organize your expenses, ensuring you have a clear picture of where your money is going. List all your line items, including baby items, childcare costs, and monthly expenses. Hint: use the one in this post!

2. Take advantage of sales and deals: Look for special deals and discounts on baby items. Many websites and influencers offer exclusive deals that can save you money on essential purchases. Do your research and compare prices before making any big purchases.

Here’s few to consider:

- Target’s Bi-Annual Car Seat Trade In Event

- Prime Day

- Nordstrom Sale

- Amazon Baby Sales

3. Set a budget and savings goals: Determine how much you can afford to spend and save each month. Having a set budget will keep you on the right track and prevent overspending. Set savings goals to ensure you’re building a financial cushion for your family’s future.

4. Consider second-hand and borrowing options: Many baby items can be purchased second-hand or borrowed from family and friends. Check online marketplaces, local buy/sell groups, and Facebook groups for affordable baby gear. Just make sure to inspect items for safety and cleanliness before use.

5. Maximize your insurance coverage: Review your health insurance policy to understand what’s covered during pregnancy, childbirth, and for your baby’s medical expenses. If you hit your deductible, it might be a good time to get any additional visits in you’ve been waiting on.

6. Utilize government resources: Research government programs available in your area that provide support for new parents. This could include assistance with childcare costs, medical expenses, or parental leave benefits.

7. Plan for parental leave: Understand your options for paid or unpaid parental leave and plan your finances accordingly.

8. DIY baby products and meals: Making your own baby food and baby products can be a cost-effective option. It’s often healthier too!

Research recipes and methods for creating homemade baby food and natural baby products.

9. Optimize your credit score: Maintaining a good credit score is important for your financial well-being. Pay your bills on time, manage your credit card usage wisely, and minimize outstanding debts. A good credit score can help you secure better interest rates and financial opportunities in the future.

10. Involve family and friends: Share your baby registry with loved ones and consider hosting a baby shower. Family members and friends may be eager to contribute to your baby’s needs, saving you money on essential items.

Remember, every little bit of saving adds up over time. By being mindful of your spending, utilizing discounts, and making smart choices, you can provide for your new bundle of joy without breaking the bank.

FAQ

What is a realistic budget for a newborn?

The budget for a newborn can vary depending on location and individual circumstances, but a realistic estimate is typically between $200 and $500 per month. You’ll need things like

diapers, formula or baby food, clothing, and healthcare costs.

What should be included in a baby budget?

A comprehensive baby budget should include expenses for diapers, formula or baby food, clothing, healthcare (including medical visits and insurance costs), childcare, baby gear (such as a crib, stroller, car seat), and miscellaneous items like toys and baby proofing supplies.

How to afford a baby on a tight budget?

To afford a baby on a tight budget, consider strategies like those mentioned above. This includes purchasing second-hand items, accepting hand-me-downs, utilizing community resources and support, focusing on essential purchases, budgeting meticulously, and exploring government programs or assistance available for low-income families.

What’s the biggest expense of having a baby?

Childcare tends to be one of the biggest expenses of having a baby. The cost of daycare, nanny services, or babysitters can significantly impact a family’s budget.

Other major expenses include healthcare, particularly if the family’s insurance coverage is limited, and housing if additional space is needed for the baby.

The Best Baby Budget Worksheet for Parents

Utilizing a baby budget worksheet is a fantastic way to get your finances on the right track and prepare for the arrival of your new bundle of joy.

By tracking your expenses, setting savings goals, and making smart financial choices, you can navigate the world of baby expenses with confidence.

Remember, every little bit of planning and saving adds up, and before you know it, you’ll be celebrating your baby’s milestones while knowing you’ve got your finances in order.

So, sit down, relax, download that baby budget template, and get ready to welcome your little one into the world with open arms and a solid financial plan.

Related: